Your credit score can vary based on a variety of factors. Learn why your credit score varies depending on the credit scoring model used.

Your credit score can vary for a number of reasons, including when and where you check your credit score.

While small differences are normal, large differences in scores may indicate an error or identity theft.

It is important to check your credit report regularly and correct any errors found immediately to avoid lowering your credit score.

If you’ve ever tried to buy a new car, rent an apartment, or just wanted to know your credit score, you may have noticed that different sites have different scores, even on the same day. The three numbers you see on your computer screen may vary depending on the credit scoring model used and when your score is checked. In this article, we’ll take a closer look at why your credit score varies and the differences between scoring models.

How is a credit score calculated?

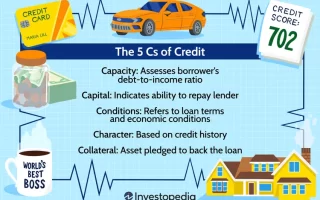

Credit scores are calculated based on a number of factors such as

- Length of credit history

- Payment Date

- Amount owed (including your credit utilization percentage)

- New credit

- Credit wallet

These factors may vary depending on the credit scoring model used by the credit bureau. For example, Equifax® scores may include different factors than TransUnion® scores . Differences in scoring models can lead to differences in credit scores.

4 reasons why credit scores vary

1. Your credit score depends on the scoring model used

The FICO® Score and VantageScore® are the two most commonly used credit scoring models, and both give scores between 300 and 850. Most individuals can access it through their bank account or credit card account.

FICO score

FICO (scoring model created by Fair Isaac Corporation) is one of the oldest credit scoring models and is used by 90% of major lenders in the United States to evaluate creditworthiness . 1 The FICO scoring model is credit bureau specific, so different credit bureaus may look at an individual’s information slightly differently, resulting in different scores.

Advantage points

The VantageScore model, developed by the three major credit bureaus, uses machine learning to paint a more accurate picture of an applicant’s credit file. The VantageScore model works with credit reports from all three credit bureaus.

The latest versions of FICO Score 10 and VantageScore 4.0 use more data to improve the reliability of reporting and better predict lender behavior. For example, VantageScore 4.0 includes rent and utility bills, information that was typically left out of credit scoring models in the past . 2 There are also industry-specific credit scoring models, such as the FICO Auto Score for auto loans. Lenders may choose to use different models for different reasons. Depending on the scoring model used, there may be some fluctuations in your score.

FICO and VantageScore regularly update their models, but not every credit reporting agency or lending industry uses the most recently updated models. Different agencies and scoring models are used to paint a specific picture of the credit sought by lenders.

2. Your credit score may vary depending on the type of credit you are applying for

Before getting approved for a loan or credit card, most lenders will obtain your credit report and score from Experian, Equifax, and/or TransUnion. Even if each credit bureau has the same information, lenders may use different credit scoring models or different versions depending on the type of credit being applied for.

For example, if you apply for a mortgage, a lender may use a FICO score of 2 or 5 to verify your score. But if you apply for a car loan, the lender may use FICO Autoscoring Version 9. This is because each scoring model is based on industry-specific risk behavior so lenders can make more informed approval decisions. 3 Some factors, such as paying on time , may be more important to an auto lender than others, such as using a lower credit limit ratio. Using different models, each model may result in slightly different scores.

3. When is it important to check your credit score?

There may be some differences depending on when your credit score was established. For example, if you recently made a large purchase and haven’t paid it off yet, your score may reflect higher credit utilization than usual, causing your score to drop a few points. Once you pay bills and update your credit report, your score may increase.

With good credit habits, your credit score usually won’t fluctuate much. If you notice that your credit score fluctuates dramatically, or changes significantly over a short period of time, it’s a good idea to check your report for any errors.

4. Errors on your credit report can change your score

If you notice a significant discrepancy in your credit score, it’s a good idea to check your credit report for any errors. Even a simple mistake can affect your credit score. If there’s something really wrong with your credit score (not just a few points), check for some common mistakes that could be causing it, like:

- Mistaken Identity: A large discrepancy in your credit score could be due to something as simple as someone’s name or address similar to yours and their information mixed up in your report — or it could be the result of something more serious. Symptoms, such as identity theft.

- Account Changes: Have you recently closed or opened an account that’s not showing up? Was the account paid in full but is now listed as delinquent? Were you recently added as an authorized user to your account, but reports show you are the new primary account holder?

- Data error: Is the credit limit incorrect? Are the dates ambiguous?

If you find any errors, make sure to fix them as soon as possible. You should first contact the credit reporting agency you use; Instructions on how to do this should be included in your credit report. If contacting the agency doesn’t resolve the issue — and you determine the error is legitimate — you may want to file a complaint with the Consumer Financial Protection Bureau, a U.S. government agency created in 2010 to protect consumers . 4

There is no need to panic about having a different credit score. In fact, small fluctuations are not only normal, but expected. The difference may simply be whether you’re looking at a FICO Score or VantageScore, as each uses a different algorithm. Additionally, the three major credit bureaus operate independently, update at different times, and may rely on different scoring models (and versions of those models) depending on the reason for checking your credit in the first place. But if you notice significant differences, it’s worth checking for errors.

Ryan Lynch is a freelance writer, educator, and musician whose work focuses on finance, STEM, and the arts.

All Credit Intel content is written by freelance writers and is commissioned and paid for by American Express.

Find the right credit card based on your credit score

Your credit score is an important part of getting approved for a credit card. Factors like rewards, annual percentage rate (APR) and fees can help you choose the right credit card based on your credit score.

Tell me more