Financial institutions attempt to reduce the credit risk of borrowers by performing credit analyses on individuals and businesses applying for new credit accounts or loans.

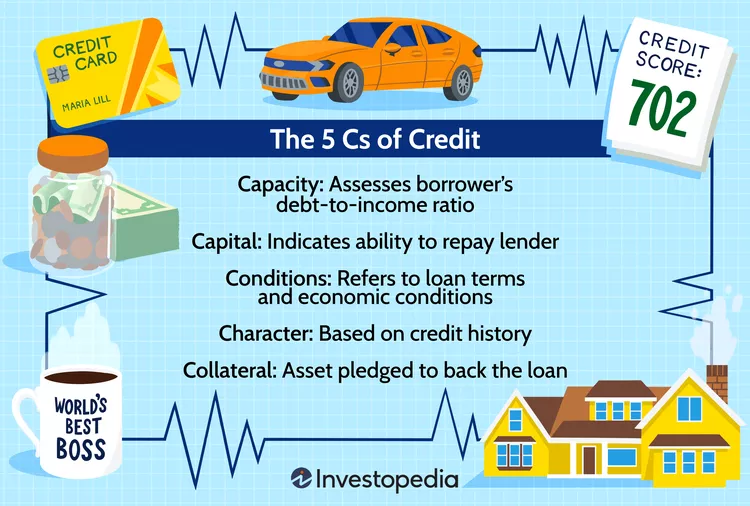

This review process is based on a review of five key factors that predict the likelihood that a borrower will default. They are known as the five Cs of credit and include capacity, capital, terms, character and collateral. There is no regulatory standard requiring the use of the five Cs of credit, but most lenders review much of this information before allowing a borrower to borrow.

Lenders measure the 5Cs of credit in different ways, some qualitatively and some quantitatively, as they don’t always lend themselves to numerical calculations. While each financial institution uses its own process to determine creditworthiness, most lenders look most heavily at the borrower’s ability.

capacity:

Lenders need to make sure that the borrower has the ability to repay the loan based on the amount and terms offered, so they will take your creditworthiness into consideration.

For business loan applications, financial institutions review the company’s previous cash flow statements to determine projected operating income. Individual borrowers provide detailed information about their income and employment stability.

Affordability is also determined by analyzing the amount and size of a borrower’s current outstanding debts compared to expected monthly income or earnings.

Most lenders have specific formulas to determine whether a borrower’s credit profile is acceptable. For example, mortgage companies use a debt-to-income ratio, which is the percentage of a borrower’s monthly debt obligations as a percentage of their monthly income.

Lenders consider high debt-to-income ratios to be high risk and can lead to default or changes in repayment terms that increase costs over the life of the loan or line of credit.

capital:

Lenders also analyze a borrower’s asset level when determining creditworthiness. Business loan application capital includes personal investment in the company, retained earnings, and other assets controlled by the business owner.

For personal loan applications, capital includes savings or investment account balances. Lenders view equity as an additional means to repay debt if income or earnings are interrupted during the loan repayment period.

Banks prefer borrowers with large amounts of capital because it means the borrower has some stake. If the borrower’s own money is involved, it gives them a sense of ownership and increases the incentive to default on the loan. Banks quantify capital as a percentage of the total investment value.

situation:

Terms refer to the terms of the loan itself, as well as any financial conditions that may affect the borrower.

Commercial lenders look at criteria such as the strength of the overall economy and the purpose of the loan. Financing for working capital, equipment or expansion are common reasons listed on commercial loan applications. While this criteria applies more to business applicants, individual borrowers are also analyzed for their financial reasons for borrowing. Common reasons include home improvements, debt consolidation or financing a large purchase.

Terms are probably the most subjective of the 5Cs of credit and are primarily assessed qualitatively. However, lenders also use certain quantitative metrics to evaluate terms, such as the loan interest rate, principal amount, and repayment period.

Features:

A credit history is a record of a borrower’s reputation or financial standing. Lenders sincerely believe in the old saying that past behavior is the best predictor of future behavior.

Each institution has its own formula or methodology for determining a borrower’s character, integrity, and reliability, but this assessment generally involves both qualitative and quantitative methods.

As part of a character check, lenders may review an applicant’s credit history or credit score, which is normalized based on overall criteria by credit reporting agencies.

If a borrower has mismanaged debt repayments in the past or has been bankrupt before, their character will be less acceptable than a borrower with a good credit history.

ensure

The personal assets that a borrower pledges are called collateral. A business borrower might use equipment or accounts receivable to obtain a loan, while a personal borrower will often pledge savings, a car, or a home as collateral.

Applications for secured loans are more popular than unsecured loans because the lender can repossess the asset if the borrower stops making payments. Banks measure this quantitatively by the value of the collateral and qualitatively by how easy it is to liquidate.

Investopedia/Alan Lindner

How do you build credit?

You can build credit in a number of ways, including making on-time payments and paying the minimum payments. When you are able to reduce your overall debt burden, including your monthly payment obligations, you can improve your affordability. You can also build credit worthiness by increasing your income.

What is a Good FICO Credit Score?

A credit score of 670 or more is considered good. A score of 740 or more is considered very good, and a score of 800 or more is considered excellent. A score of 580 to 669 is considered fair.

How to Find Your FICO Score?

You can check your FICO score on the FICO website. If you have a credit card, your credit card provider may also provide you with your score, which is updated monthly. You can also get a free copy of your credit report each year from the three major credit bureaus at AnnualCreditReport.com.

in conclusion

Each financial institution has its own way of analyzing a borrower’s creditworthiness, but the five Cs of credit are common to both personal and business loan applications. The first five, primarily the borrower’s ability to generate cash flow to repay the interest and principal of the loan, are generally considered the most important. But applicants who score high in each category are more likely to receive larger loans, lower interest rates, and more favorable repayment terms.