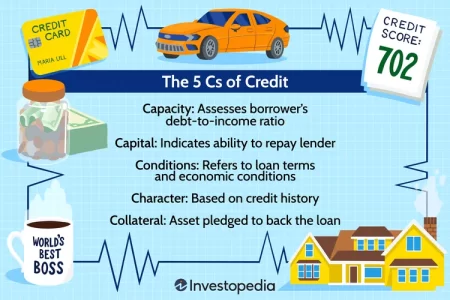

Lenders use your credit score to determine how likely you are to repay a loan or credit card. Generally speaking, the higher your credit score, the more likely they are that you should pay back your debts on time. So if your credit score has dropped, it’s important to understand why. Actions that can cause …